How to correctly value the community property interest in a public retirement plan such as the Public Employees Retirement Association of New Mexico

(PERA State General Plan 3)

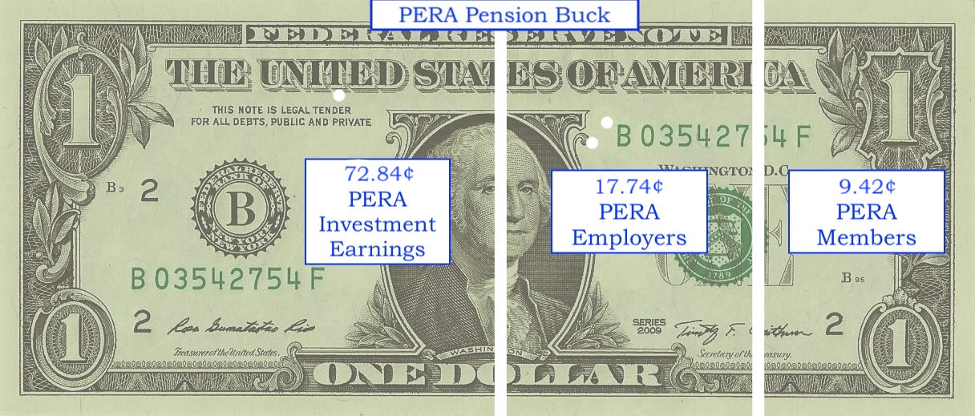

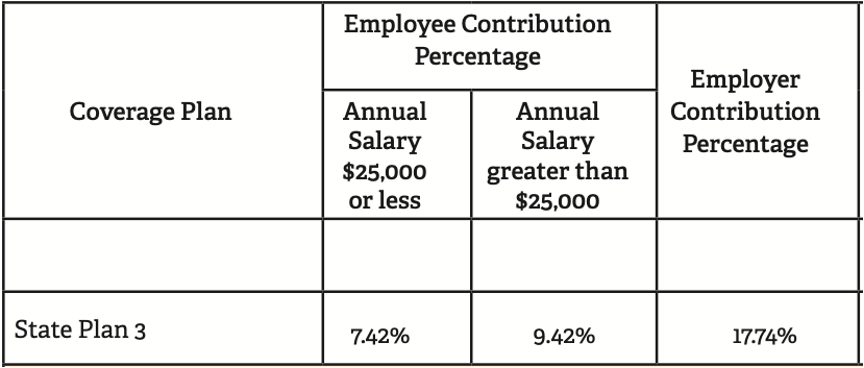

The majority of a member’s pension is funded by their employer and future investment earnings, and not by the member directly. This fact is noted in the member booklets and Annual Member Statement issued by the retirement system. The amount a PERA member is required to pay into the retirement system (which can be as high as 18.15% of their pay) depends on the membership classification.

As these two illustrations show, member contributions clearly only cover a small portion of the overall funding requirements.

Example:

Assume a PERA State General Plan 3 member is retiring at 55 with 25 years of service, final average salary of $3,500 per month and $80,000 in their member contribution account. The member will receive a lifetime benefit of $2,625 per month (25 x $3,500 x .03 = $2,625), plus cost-of-living-adjustments. The actuarial present value of this income stream is approximately $750,000, not the $80,000 in contributions and interest found on the Annual Member Statement. It would take only 2.54 years of receiving $2,625 per month to fully deplete the $80k member contribution account (excluding interest), and yet the benefit continues for the member’s lifetime.

Practice Tip:

Many judgments erroneously rely on only the member contributions and interest (which is approximately 6%-18% of the total value) instead of the full actuarial value of the public retirement plan. Such errors in disclosing the full value of the pension can result in an inequitable division of community property, often times leading to an omitted asset, setting aside the Judgment or requiring a recalculation of spousal support.

While “best practice” means relying on actuarial value to determine the full value of a member’s public retirement system benefit, this does not mean the family law attorney is required to value the pension for purposes of buyout or offset. On the contrary, if the parties prefer to divide the community property interest equally by Domestic Relations Order (DRO), then no actuarial valuation is required. HOWEVER, the parties must understand that even with a properly prepared DRO in place, in almost all cases the election of a lump sum from the retirement system will provide only a fraction of the value of every dollar payable with respect to the total accrued benefit.

Practice Tip:

The member and nonmember must leave their share of the member contributions and interest on deposit with the retirement system in order to receive a monthly benefit equal to the full actuarial value of the pension (provided that the member is vested).

While calculating the actuarial value of a member’s pension for purposes of a complete buyout may be inappropriate in some circumstances, obtaining an actuarial valuation from a qualified expert may still prove extremely useful to the family law attorney and client.

Examples:

(a) What if the clients have agreed for the nonmember to retain the family home and wish to partially offset the nonmember’s interest in the PERA pension against the equity in the home? It is possible to award the nonmember less than 50% of the community property interest in a Domestic Relations Order (e.g. 43.50% of community), whereby the 6.5% reduction is actuarially equivalent to one-half of the equity in the family home.

(b) Perhaps the parties have been separated for a long time and member has been collecting their pension without paying a portion to the nonmember? It is possible to actuarially value the prospective pension and increase the nonmember’s percentage share as reimbursement for past pension payments in arrears.

Regardless of whether the parties are entertaining the idea of a complete buyout or partial offset of the nonmember’s community property interest in a public retirement plan, obtaining an actuarial valuation is a quick and cost effective way to ensure all parties understand the true value of what is commonly the most valuable asset in a divorce.

Moon, Schwartz & Madden have been qualified as experts in California in the actuarial valuation and division of retirement plans, including survivor benefits, since 1993 and now offers these services in New Mexico and Arizona. We are members of the “QDRONEs” which is a national educational society of lawyers, actuarial consultants, and other QDRO professionals. www.msmqdros.com

The following is a sample valuation report from Moon, Schwartz & Madden

Article published in theSanta Barbara Lawyer, Issue 571. The publication can be found here.